- #See finance vs ibank vs moneydance update#

- #See finance vs ibank vs moneydance full#

- #See finance vs ibank vs moneydance code#

- #See finance vs ibank vs moneydance download#

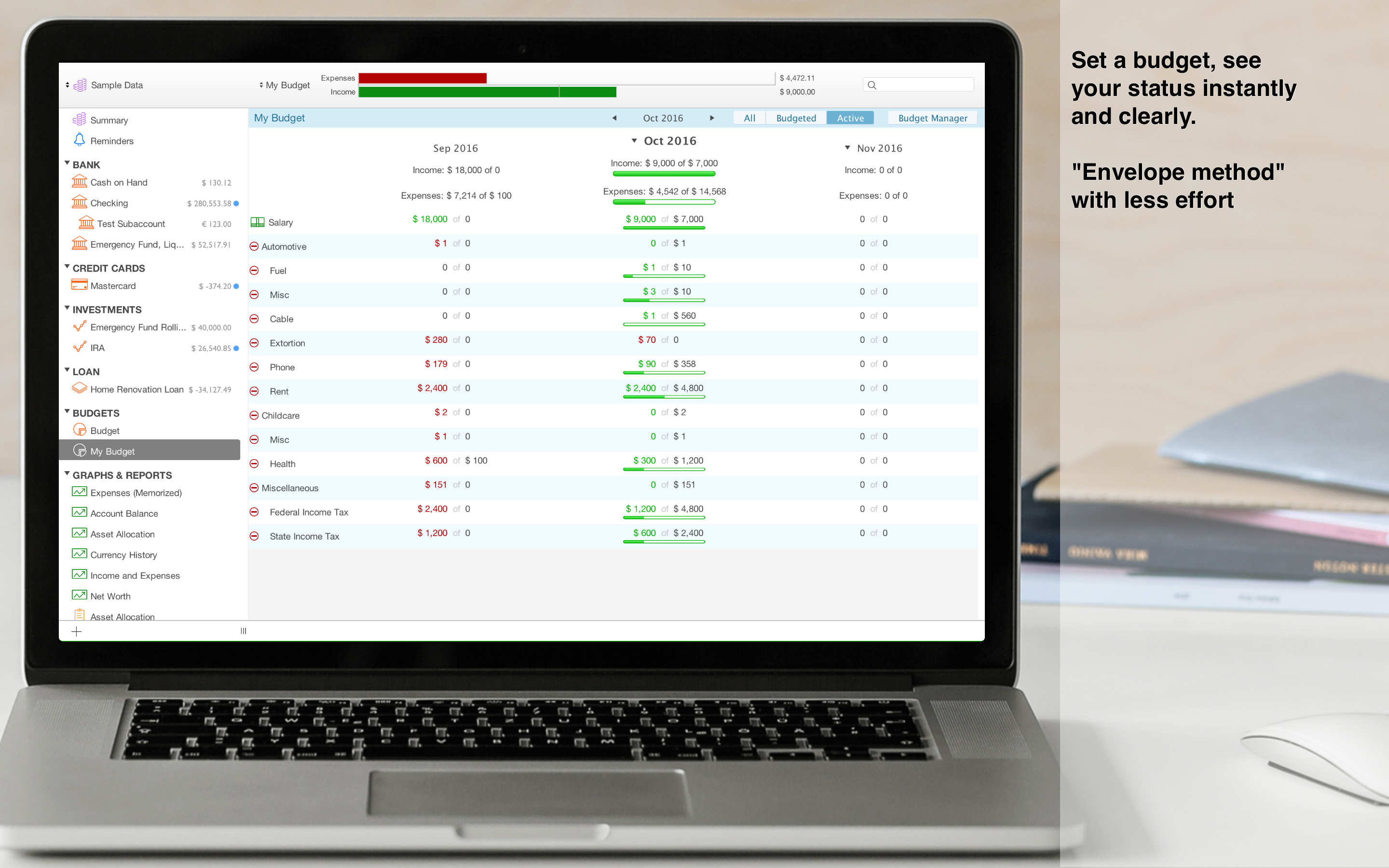

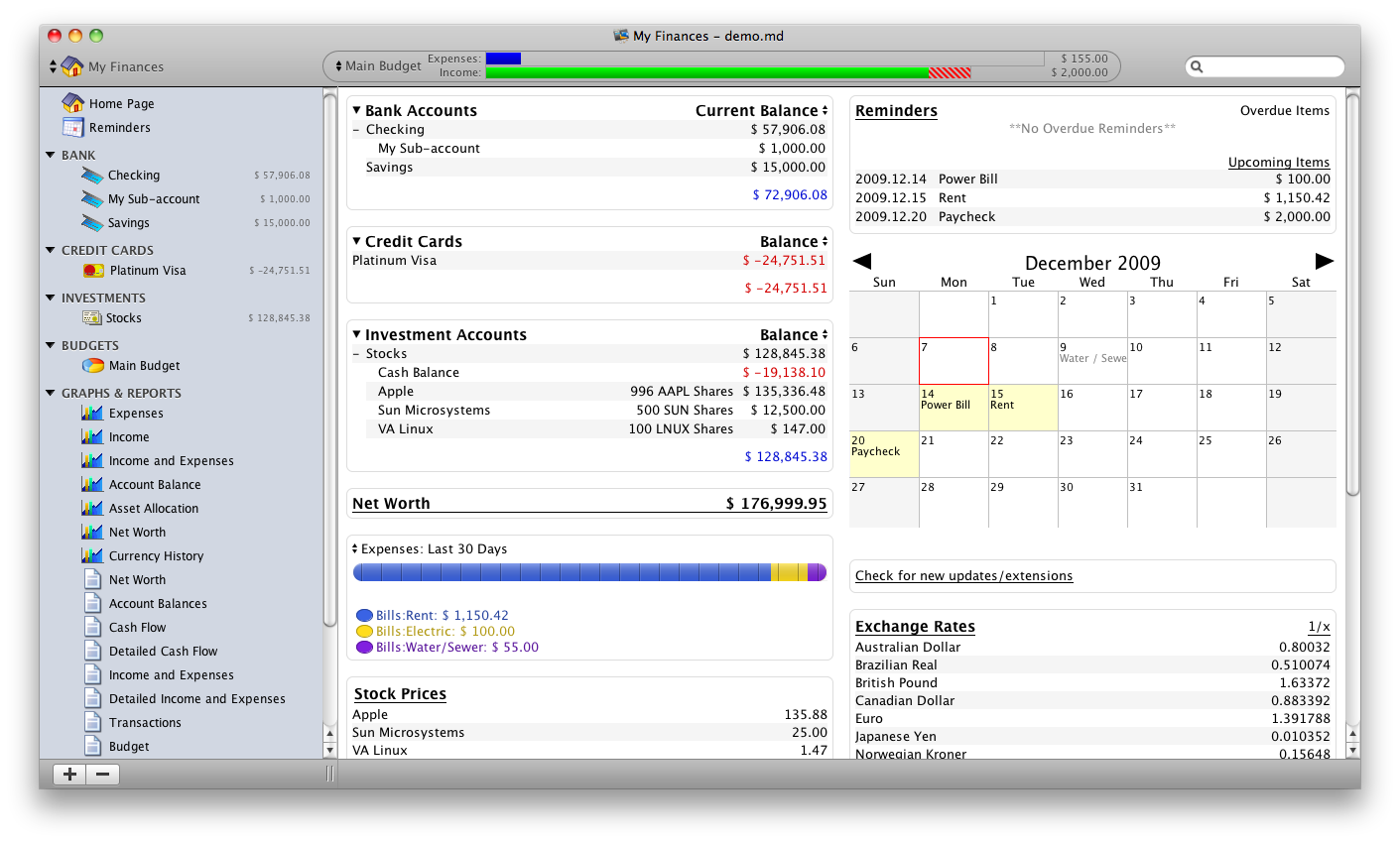

However, because it was not available on the app store, I had to activate it every time I reset my mac and that is often! Since then I have been using Banktivity (iBank as was its previous name) and I was fairly satisfied. In 2012 I tried SEE Finance and I loved it. Starting with MS Money in the early 90s, Quicken, Moneydance, Moneywiz, Fortora etc. I think I must have used the majority of personal finance applications over the years. Import OFX, QFX, CSV, QIF, and QMTF files iCloud Drive lets you access your files from multiple devices, keeps them secure, and under your control. Unlike similar programs, there's no forcing you to upload your personal data to a service outside of your control in order to access it from multiple devices. SEE Finance allows you to choose where you keep your data. Designed to give users complete control over their data. Store your file(s) on iCloud Drive and access them from your Mac, iPhone and iPad. These are only a few of the many, many options available to you to personalize the app just for you.

#See finance vs ibank vs moneydance code#

Adjust the information shown for transactions, increase font sizes, color code just about everything, tweak import settings, and generate custom reports.

#See finance vs ibank vs moneydance full#

Packed full of options to allow you to take total control of your finances. Perform these tasks and more in any of the 150+ different currencies available. Track and monitor your individual investments and your investment portfolio as a whole. Generate a variety of customizable reports and budget to keep your spending on target. Track all of the financial accounts you might have including banking, credit cards, investments and others. There's a long post of some of the challenges of migrating somewhere in their blog, which more or less corresponded with my testing.Manage all of your financial accounts in a single place and gain control over your finances. USD 10 + GBP 15 will show Bank Interest of 25, which is numerically correct, but not the correct value. What I mean by that is the Bank Interest category will be the sum of all the numbers of the transaction regardless of their currency i.e. This means that if you have a USD account and a GBP account and you try to apply bank interest you will encounter issues, most simply the bank interest will give a "number" not a value. The crux of the problem is that currency is an account level attribute as opposed to a transaction level attribute. There are also a number of data model inconsistencies that you should be aware of if you go down this route the most significant being if you use multi currency (which I concede is niche). There was an acknowledged bug in the import process with QIF files. Now I think I'll just get a cheap M1 MacBook Air just so I can run Banktivity.

I wanted to get out of the Apple ecosystem because their laptops sucked for a while. In the end, I nearly got the conversion to work, but decided that the MD interface was too ugly to look at on a daily basis and I couldn't get stock quotes to work. Had to do a small amount of Perl programming. There are many kinds of investment transactions that Banktivity has that MoneyDance won't accept.

Spent dozens of hours trying to convert the QIF file exported by Bankttivity to something that MoneyDance would accept. I track the actual investments within my brokerage accounts.

#See finance vs ibank vs moneydance update#

I just update my account balances the last day of every month to keep track of my net worth. The downside there is they have - understandably - decided to focus on budgeting and so don’t do investment tracking. Hands down the best budgeting app out there is You Need A Budget.

If you need to be able to sync and want off the Apple ecosystem you’re almost certainly going to need to pay a subscription fee unless you go with Personal Capital or Mint.

#See finance vs ibank vs moneydance download#

I don’t know how import the direct import/transaction sync is.Ī couple other options: open source options like HomeBank, GnuCash, KMyMoney, and MoneyManagerEx where you’d need to download your transactions to a file and import. Trying to import a year’s worth of history is a pain. Whenever I try a new app I usually do current balance on each account and set up budgets and try it for a month. MoneyDance interface is one of its few big week points.

0 kommentar(er)

0 kommentar(er)